Non-Employee Expense Reports FAQs

Questions relating to the Non-Employee Expense Reports in ECM are grouped into the following categories for ease of use:

Preparer/Approver FAQs

Payee FAQs

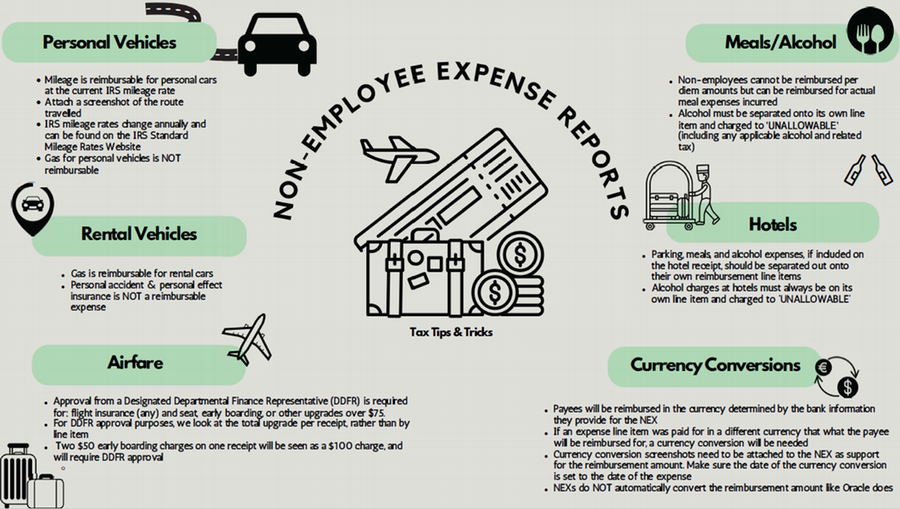

Printable Tips and Tricks for Completing a Non-Employee Expense Report (NEER)

[Click here or on the image above to access a larger, printable version]